13 Bank accounts attached with my PAN but income tax running away from the matter while this failure concerns NSDL a cell of income tax

Appeal Details

Appeal Number

CBODT/E/A/23/0002058

Name

Yogi M. P. Singh

Appeal Recieved Date

09/05/2023

Reason Of Appeal

Not a single transaction belongs to applicant. Here my PAN connected with my Aadhar number has been misused. Because of corruption, department of income tax is not looking into the matter. Please order a transparent and accountable enquiry into the matter. More than 90 percent officers are corrupt which is the root cause of such anarchy.

Appeal Status

Appeal Closed (On 13/07/2023)

Closing Remarks

1. The ground of appeal and the reply of the PG Officer have been carefully examined. 2. The issue raised in the grievance is not related to CBDT as the issue related to CIBIL score, therefore the applicant is advised to file fresh grievance with the department concerned or DARPG through PG Portal. 3. With these remarks, appeal of the appellant is disposed off with no further action.

Grievance Details

Registration Number

PMOPG/E/2023/0080574

Name

Yogi M. P. Singh

Date of receipt

14/04/2023

Address

Mohalla Surekapuram Colony Shri Laxmi Narayan Baikunth Mahadev Mandir Shri Laxmi Narayan Baikunth Mahadev Mandir

State

Uttar Pradesh

District

Mirzapur

Mobile Number

7379105911

Email ID

yogimpsingh@gmail.com

Phone Number

Not Provided

Grievance Description

Central Board of Direct Taxes (Income Tax) >> Corruption/Malpractices related (VCs, employees) >> Inaction by Income Tax Department

Name and Desination of Officer : Manish Mishra, CIT e-Verification

regional office / Office : DGIT(Systems) CPC, E-filing

-----------------------

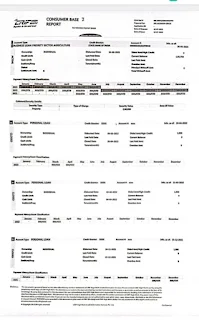

16 MAR 2023 440.00 TRANSFER TO 35344212700 TRANSUNION CIBIL LIMI - INB CIBIL request charges -SER2023031616789 62260158IHR27512 30 Respected sir the screenshot of the aforementioned transaction is attached to the grievance in PDF form. One month passed, unfortunately State Bank of India did not provide the applicant CIBIL report. The root cause of not providing the CIBIL report is the anonymous transactions made by cheaters by misusing my Aadhar Card and PAN card by colluding with the staff of the income tax and State Bank of India.CIBIL score and CIBIL report is automatically made available by NSDL but after payment of Rs.440 through SBI internet banking, CIBIL report was not made available.

CIBIL Report is an automatic process coordinated by the department of income tax and state bank of India unfortunately not providing after payment is showing mysterious dealings of aforementioned public authorities.

The reply of the state bank of India is as follows.We have to state that we have escalated your issue to our IT /INB support team CBD Belapur Mumbai for needful action at their end सादर / Regards Assistant General Manager State Bank Of India

Sir, there is no cibil score and cibil report but there is little change in the status that it is showing successful. Which means State Bank of India is saying that I have payment of Rs. 440 for cibil report but still there is no cibil report.

The matter concerns deep-rooted corruption in the working of state bank of India and department of income tax.How can they overlook the matter in such a negligent way. Grievance Status for registration number : DEABD/E/2023/0026488

Grievance Concerns To Name Of Complainant-Yogi M. P. Singh, Date of Receipt 16/03/2023, Received By Ministry/Department-Financial Services (Banking Division)Please provide CIBIL report to the applicant.I have applied for a CIBIL report through the internet banking of the State Bank of India. It is unfortunate you did not provide the CIBIL report concerning

Grievance Document

Final Reply

Dear Sir/Madam, on perusal of the grievance it is observed that taxpayer has not provided the AY details. The earlier CPGRAM mentioned is also not available with CPC. It may kindly be noted that without AY no data/records can be verified by CPC. Hence the taxpayer is requested to either update the AY details in this grievance or file a fresh grievance with PAN and AY details so that CPC can proceed further to examine and resolve the issue.

Communication Details

Sn. Date of Action Action From To

1 14/04/2023 RECEIVED THE GRIEVANCE You Prime Ministers Office

2 14/04/2023 REMINDER RECEIVED FROM COMPLAINANT You Central Board of Direct Taxes (Income Tax)

3 09/05/2023 CASE DISPOSED OF Central Board of Direct Taxes (Income Tax) You

Comments

Post a Comment

Your view points inspire us