Department of Income tax, government of India sends streams of notices to file income tax return without examining records reflects anarchy

Grievance Status for registration number : CBODT/E/2022/29538

Grievance Concerns To

Name Of Complainant

Yogi M. P. Singh

Date of Receipt

18/08/2022

Received By Ministry/Department

Central Board of Direct Taxes (Income Tax)

Grievance Description

Central Board of Direct Taxes (Income Tax) >> Corruption/Malpractices related (VCs, employees) >> Inaction by Income Tax Department

Name and Desination of Officer : Anonymous

regional office / Office : DGIT (Systems)

-----------------------

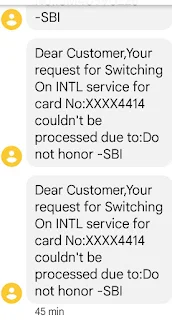

An F.I.R. may be registered against senior rank staff of the department of income tax of the government of India who conspired to pressurize the staff of State Bank of India to register the PAN Card of the applicant in the anonymous SBI Account as told by staff of State Bank of India confidentially to the applicant. एक एफ.आई.आर. भारत सरकार के आयकर विभाग के वरिष्ठ रैंक के कर्मचारियों के खिलाफ पंजीकृत किया जा सकता है, जिन्होंने स्टेट बैंक ऑफ इंडिया के कर्मचारियों पर दबाव बना कर गुमनाम एसबीआई खाते में आवेदक के पैन कार्ड को पंजीकृत करने के लिए भारतीय स्टेट बैंक के कर्मचारियों पर दबाव बनाने की साजिश रची थी। भारतीय स्टेट बैंक के एक बिश्वसनीय कर्मचारी द्वारा यह रहस्योद्घाटन किया गया वह भी किसी को नाम न बताने के शर्त पर

For PAN and other details, vide attached document to this grievance. Everyone knows that PAN Number is updated to its own bank account and applicant made efforts to connect my PAN Card to my Bank account but never succeeded but an anonymous person succeeded to register my PAN Number in his own account and has opened an animal husbandry firm by taking the loan from the State Bank of India. Now he is doing huge transactions from his bank account and for those transactions and business, the department of Income Tax is issuing income tax notices to the applicant causing mental trauma to the applicant. Whether it is not mismanagement and reflects deep rooted corruption in the working of the department of Income TAX. Sir you and your subordinates know various tricks to pave the way of Tax evasion and by colluding with unethical businessmen your corrupt fellows apply such cunning tricks to cheat the innocent and gullible people. सर आप और आपके अधीनस्थ टैक्स चोरी का रास्ता साफ करने के लिए तरह-तरह के हथकंडे अपनाते हैं और अनैतिक कारोबारियों की मिलीभगत से आपके भ्रष्ट लोग इस तरह से मासूम और भोले-भाले लोगों को ठगने के लिए चालाकी भरे हथकंडे अपनाते हैं I humbly request you, Honourable Sir to take following steps.1-The matter may be referred to the central bureau of investigation which may provide its report regarding slip culture at the place of cash memo, non maintenance of records by proprietors of the firms and using PAN Cards of others to carry on its own business by taking corrupt staff of the department of Income Tax in good faith. 2-High level team may be constituted of honest public personnel in my matter so that my PAN Card may be freed from the clutches of the fraud bank account holder performing huge transactions in my name because of the corruption in the department of income tax. 3-Corrupt sheep from the department of income tax may be fished out by launching a special drive so that corruption may be overcome to some extent.

Grievance Document

Current Status

Under process

Date of Action

18/08/2022

Officer Concerns To

Officer Name

Sh. Y. K. Singh (DGIT)

Organisation name

DIRECTOR GENERAL OF INCOME TAX (SYSTEM)

Contact Address

ARA centre GROUND FLOOR, E-2, JHANDEWALAN EXTEN NEW DELHI-110 055

Email Address

dgit.systems@incometaxindia.gov.in

Contact Number

01120920385

एक एफ.आई.आर. भारत सरकार के आयकर विभाग के वरिष्ठ रैंक के कर्मचारियों के खिलाफ पंजीकृत किया जा सकता है, जिन्होंने स्टेट बैंक ऑफ इंडिया के कर्मचारियों पर दबाव बना कर गुमनाम एसबीआई खाते में आवेदक के पैन कार्ड को पंजीकृत करने के लिए भारतीय स्टेट बैंक के कर्मचारियों पर दबाव बनाने की साजिश रची थी। भारतीय स्टेट बैंक के एक बिश्वसनीय कर्मचारी द्वारा यह रहस्योद्घाटन किया गया वह भी किसी को नाम न बताने के शर्त पर

ReplyDeleteUndoubtedly it is the real face of the income tax department Government of India.Everyone knows that why action is not being taken on the genuine representations of the public to inform the concerned senior rank officer about the tax evasion is a matter of great concern. The root cause behind the tax evasion is the prevailed corruption in the department of income tax government of India quite obvious from the dereliction of concerned staff in taking action in the case of tax evasion.

ReplyDelete